Find Trusted GA Hard Money Lenders for Real Estate Loans and Investments

Find Trusted GA Hard Money Lenders for Real Estate Loans and Investments

Blog Article

The Ultimate Overview to Locating the very best Tough Cash Lenders

From evaluating loan providers' reputations to contrasting passion prices and charges, each step plays a vital role in safeguarding the ideal terms possible. As you take into consideration these aspects, it comes to be apparent that the path to determining the right difficult money loan provider is not as uncomplicated as it may seem.

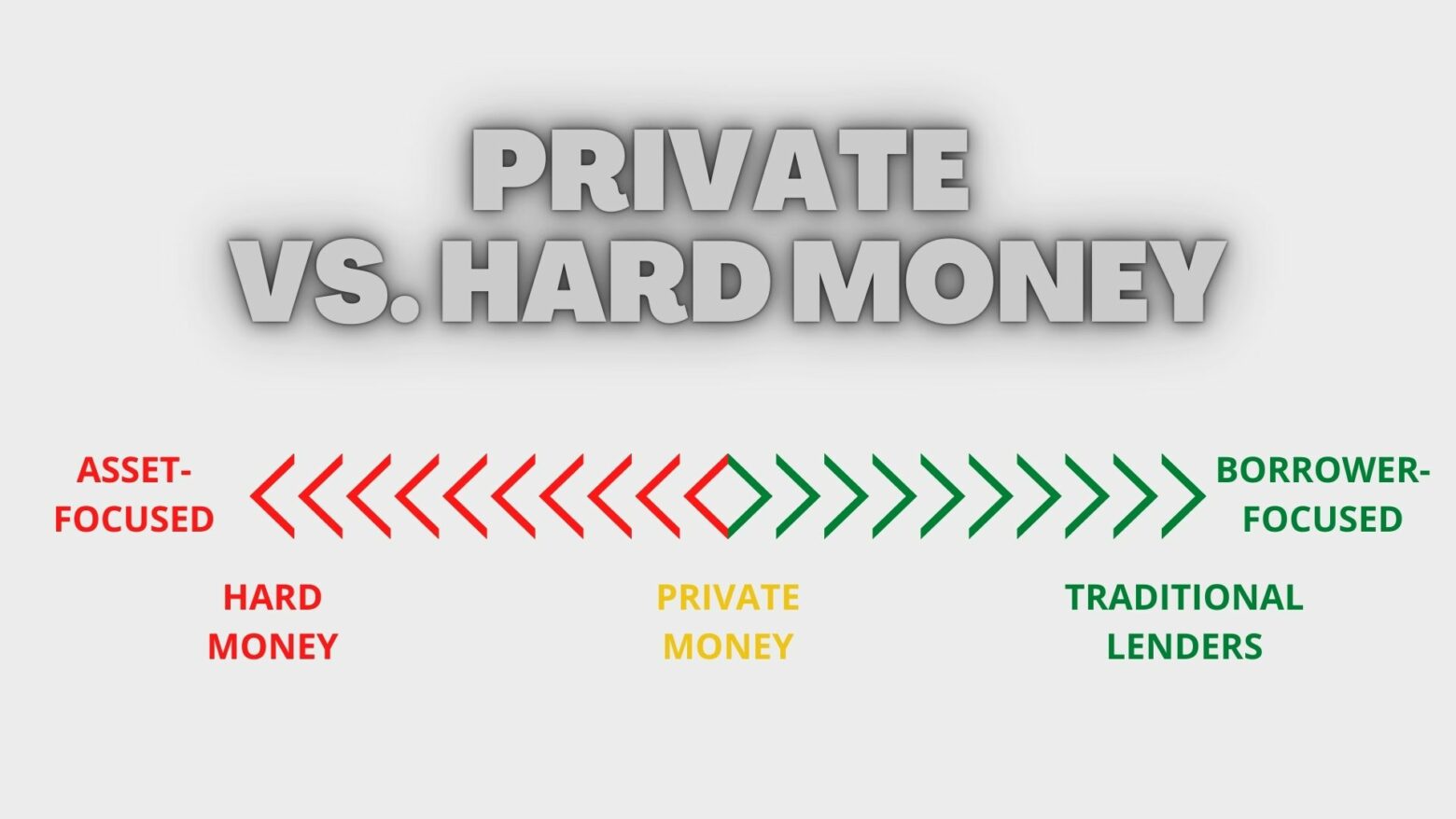

Understanding Tough Money Loans

Among the defining features of tough money car loans is their dependence on the worth of the residential or commercial property as opposed to the consumer's creditworthiness. This enables consumers with less-than-perfect credit report or those looking for expedited funding to gain access to resources more conveniently. Additionally, tough money lendings generally come with greater rates of interest and much shorter repayment terms contrasted to standard car loans, showing the increased danger taken by lenders.

These financings offer various purposes, including funding fix-and-flip projects, re-financing distressed homes, or providing capital for time-sensitive chances. Recognizing the nuances of hard money finances is important for capitalists who intend to utilize these monetary tools successfully in their real estate ventures (ga hard money lenders).

Secret Variables to Consider

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Different loan providers use differing rate of interest prices, fees, and payment routines. In addition, analyze the loan provider's funding rate; a quick approval procedure can be important in affordable markets.

An additional crucial factor is the lender's experience in your particular market. A loan provider knowledgeable about local conditions can offer beneficial insights and might be much more adaptable in their underwriting procedure.

How to Evaluate Lenders

Examining tough money loan providers entails an organized strategy to ensure you choose a companion that aligns with your investment goals. Start by analyzing the lender's online reputation within the sector. Search for testimonials, testimonials, and any offered scores from previous customers. A credible loan provider needs to have a background of successful transactions and a strong network of completely satisfied borrowers.

Following, take a look at the lending institution's experience and expertise. Various lenders may concentrate on various kinds of residential properties, such as property, commercial, or fix-and-flip projects. Select a loan provider whose know-how matches your financial investment technique, as this understanding can significantly affect the authorization procedure and terms.

One more vital aspect is the loan provider's responsiveness and interaction style. A reliable lending institution ought to be willing and obtainable to answer your concerns comprehensively. Clear interaction throughout the evaluation procedure can show just how they will certainly handle your lending throughout its duration.

Finally, guarantee that the lender is transparent regarding their demands and procedures. This consists of a clear understanding of the documentation needed, timelines, and any kind of conditions that may apply. When picking a hard money lender., taking the time to review these elements will equip you to make a notified choice.

Contrasting Rates Of Interest and Fees

A detailed comparison of rates of interest and fees amongst difficult cash lending institutions is important for maximizing your financial investment returns. Hard money financings often come with greater rate of interest rates contrasted to traditional funding, commonly ranging from 7% to 15%. Understanding these rates will certainly assist you analyze the possible costs related to your financial investment.

Along with interest rates, it is critical to review the connected fees, which can dramatically impact the total financing expense. These costs may include source fees, underwriting costs, and closing expenses, commonly revealed as a percentage of the financing amount. As an example, origination fees can differ from 1% to 3%, and some lenders might bill extra charges for processing or management tasks.

When contrasting lending institutions, take into consideration the total expense of borrowing, which incorporates both the rate of interest prices and charges. This holistic strategy will enable you to identify the most cost-effective choices. Furthermore, make certain to ask regarding any type of possible prepayment charges, as these can impact your capacity to repay the lending early without sustaining added charges. Ultimately, a cautious evaluation of rate of interest and charges will certainly bring about even more enlightened loaning decisions.

Tips for Effective Borrowing

Recognizing interest prices and fees is just component of the equation for safeguarding a hard money financing. ga hard money lenders. To ensure effective borrowing, it is essential to extensively assess your economic situation and job the prospective return on investment. Beginning by clearly defining your loaning objective; loan providers are much more likely to respond positively when they understand the desired usage of the funds.

Next, prepare a comprehensive business plan Go Here that outlines your job, expected timelines, and economic estimates. This demonstrates to loan providers that you have a well-thought-out method, enhancing your reliability. In addition, keeping a strong connection with your lending institution can be helpful; open communication promotes trust fund and can bring about much more favorable terms.

It is likewise vital to guarantee that your building satisfies the lender's standards. Conduct a thorough assessment and provide all required documents to improve the approval procedure. Be mindful of departure strategies to pay back the lending, as a clear repayment strategy assures lending institutions of your commitment.

Conclusion

In recap, finding the most effective difficult cash lending institutions necessitates an extensive assessment of different elements, consisting of lender track record, loan terms, and field of expertise in property kinds. Reliable evaluation of lending institutions via comparisons of rate of interest and charges, incorporated with a clear business strategy and strong interaction, improves the likelihood of positive borrowing experiences. Eventually, persistent research study and tactical involvement with lending institutions can cause effective financial results in genuine estate endeavors.

In addition, hard cash loans typically come with greater passion rates and much shorter repayment terms compared to traditional lendings, mirroring the raised risk taken by loan providers.

Report this page